Payment for online shopping with a credit card is the preferred way for users to pay. However, there are better options. It includes allowing them to use a payment system that keeps banking information for customers, avoiding the hassle of going through the tedious process.

These systems also protect the data of users; therefore, they are even safer for online purchases. Amazon, the world’s largest market, never misses an opportunity for an online business. As a result, Amazon Pay has its own safe and secure online payment system.

What is Amazon Pay?

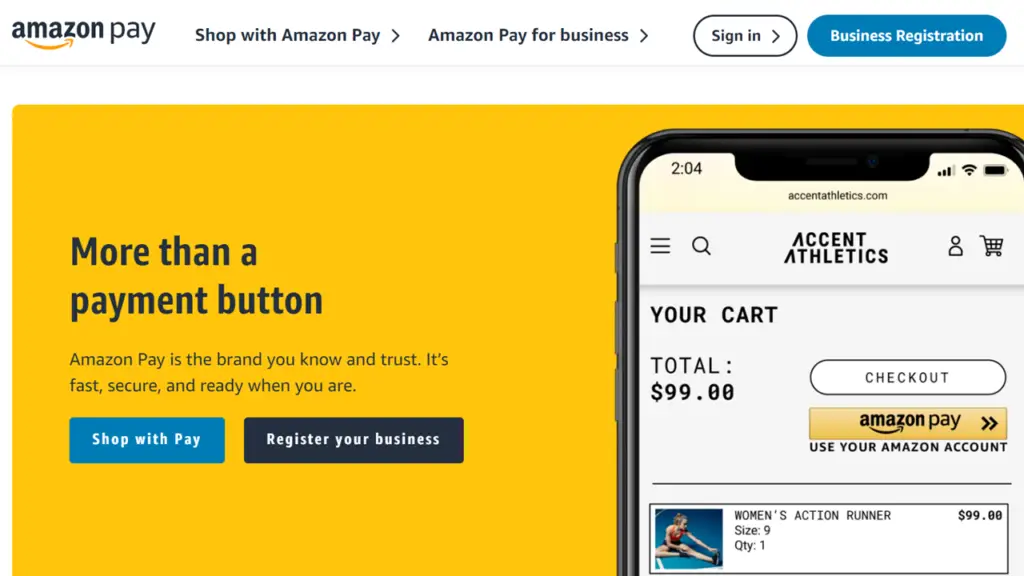

Amazon Pay is an e-commerce payment gateway that allows buyers to pay for their products or services without leaving your site, creating an account, or providing billing and shipping information manually. Charitable organizations can also pay Amazon Pay for their sites to make donations easier.

For Amazon Pay to work on a website, customers need to have an existing Amazon account. It is because the service automatically accesses customer shipping and charging information stored on Amazon.

A payment gateway is a software application that enables the secure exchange of the credit card information of a business’s customer with its payment processor. PayPal and Authorize are also popular payment gateway providers for e-commerce companies. Net and other providers, like Stripe and Square, are all-in-one payment processing systems equipped with payment gates.

Amazon Pay – At a Glance

Given below is the company profile of Amazon Pay

| Company Name | Amazon Pay |

| Website | pay.amazon.com |

| Founded in | 2007 |

| Founder | Jeff Bezos |

| Key People | Jeff Bezos – Founder, Jeff Bezos – CEO, Keren Levy – COO, Michael Levine – CFO |

| Headquarters | Seattle, Washington United States |

| Business Model | Online payment system |

| Revenue | 300 million USD |

| Competitors | PayPal, Square, Google Pay, Tipalti, Skrill, Remitly. |

How Does Amazon Pay Work?

Amazon Pay is an e-commerce solution that utilizes customers’ existing Amazon.com accounts. Simple tools can help personalize payments, shipping, sales taxes, returns, and fees. Amazon Pay also offers a simple and efficient way to integrate special sales and promotional coupons to users. The customers can pay and receive the Amazon A-to-Z guarantee without sharing the financial information.

- During the checkout, a customer clicks on the Amazon Pay logo or button. They are forwarded to an Amazon page to sign in with their Amazon login credentials.

- They go back to their website to complete the checkout.

- Then they choose the credit or debit card that they want to check out from their Amazon account.

- After payment gets processed, they receive a receipt from Amazon Pay.

What is Amazon Pay Business Model?

Amazon Pay business model is an eCommerce model but has acquired and diversified over the years to create a portfolio of business models and income streams.

Amazon Pay recently teamed up with Worldpay, a transaction company with an annual value of more than $40 billion. It not only increased Amazon Pay’s reach significantly but also gave international traders the same advantage.

Closing the purchase is simpler on websites that offer this digital wallet to their international customers. It allows customers to pay with their Amazon account instead of reentering their delivery and contact information.

There are two types of business accounts available through Amazon Pay. A person can check out and manage one-time and repeated payments and fees, integrate promotional and special sales, and monitor shipping using the “Amazon Check-out option”. The individual has access to Amazon’s chargeback controls, risk management, and fraud detection. The customers of a particular person are likely to be familiar with the typical Amazon checkout experience and likely appreciate having access to their Amazon account, which makes checking out even faster.

Purchase

Amazon Pay accepts specific payment credit and debit cards. These include VISA, American Express, Discover Network, MasterCard, Eurocard, and debit cards with STAR logos, NYCE, or JCB. Similarly, Amazon Pay also accepts VISA, MasterCard, or American Express gift cards for temporary debit cards. Users can divide debit cards and Amazon gift cards. However, they can’t divide payments between multiple debit or credit card payments.

Sales

Sellers can accept debit cards using Amazon Payments on their websites. Amazon provides payment services for two main categories: Amazon Checkout and Amazon Simple Pay Checkout. Checkout by Amazon is an online shopping cart application that enables customers to generate their own accounts on a website. Simple Pay allows customers to make one-time payments or on-site donations. With both services, customers can pay for Amazon’s debit card.

Developers

Amazon’s Flexible Payments Service (FPS) is available to businesses with web developers on their team. This service allows companies to accept payments in the same way that Amazon Payments. With FPS, however, developers can tinker with the programmed infrastructure to customize the customer shopping experience. Businesses can also accept debit card payments through Amazon using FPS. There are no monthly or one-time fees to use FPS, as there are with Amazon Payments.

How Does Amazon Pay Make Money?

Revenues are a good point to start when attempting to comprehend how Amazon Pay makes money. However, other financial measures are also crucial to consider. Amazon Pay generates the bulk of its earnings through sales. As mentioned, the company charges its users a commission-based rate. While the rates are low, the company still manages to make profits due to the high transactional volume.

Amazon Pay charges a flat fee per transaction consisting of a transaction fee and an authorization fee, as with most payment fee structures. Tax will also be collected if needed.

However, for domestic and cross-border payments, this flat fee differs:

- Domestic: 2.9% transaction charge plus 30 cents.

- International: 3.9% transaction charge plus 30 cents.

And charges for charities are slightly lower:

- Domestic: 2.2% transaction charge plus 30 cents.

- International: 3.2% transaction charge plus 30 cents.

If a person refunds, Amazon will reimburse their transaction fee, but the authorization fee will remain. If they dispute a chargeback claim, Amazon also charges $20. Amazon Pay does not charge monthly or annual fees for using its service, which means there are no early termination fees if a user cancels their account.

What are the Features of Amazon Pay?

Amazon Payments’ main features are:

- Automatic Identity Payments

- Integration of Merchant Website

- Inline Checkout

- Fraud Protection

What are the Benefits of Amazon Pay?

The most significant advantages of Amazon Pay are its general usability, extensive functionality, and mobile support. It is what users expect when they pay through Amazon:

Amazon Pay facilitates mobile or online payments to sellers. The application allows users to access merchant websites seamlessly and streamlines the purchase process without entering critical information, including names, credit card information, addresses, and more. All this is possible because Amazon has imposed security restrictions on the data.

Pay With Amazon comes with a package designed to assist startups in expanding their capabilities, assisting with business development, and strengthening customer relationships. This package provides its users with a prestigious security system, including business protection and fraud detection. This package also helps traders considerably improve their conversion rates, as the checkout process is rapid. This simplified checkout can result in improved client loyalty and fewer cart abandonment opportunities.

Conversely, Log In And Pay makes it easier to make payments on mobile phones or laptops. Users can easily browse the products in e-commerce stores and select any items and pay for them without the complexity of carriage and checkout. This tool enables users to access Amazon from a variety of websites and applications. The person can even pay for items without entering their name, credit card, address, or other information. Users may, in particular, obtain an A-Z warranty from Amazon, which means that their information is secure and included in a shop protection plan.

Conclusion

If a user wants to improve the online shopping experience for their customers and offer a safe, confident, and quick payment system, a payment gateway is the best option.

The addition of Amazon Pay as a payment option can win over a number of Amazon marketplace trusting customers. The person must only remember the disadvantages of paying Amazon fees per transaction and be comfortable with the market knowing his sales and customer history.

Overall, Amazon Pay is a great way to pay for a person’s online store and can potentially boost conversions and reduce cart loss.