Robinhood, or Robinhood Markets, is an American financial services company. The company provides commission-free security trades through its mobile app. Established in 2013, the company started its services in March 2015. Similarly, Robinhood is a FINRA-regulated broker-dealer and also registered with the US SEC.

Robinhood’s headquarters are in Menlo Park, California. Robinhood services over 31 million users as of 2021. The company was founded by Vladimir Tenev and Baiju Bhatt. The company focuses on providing everyone with access to financial markets. That is also where it gets its name.

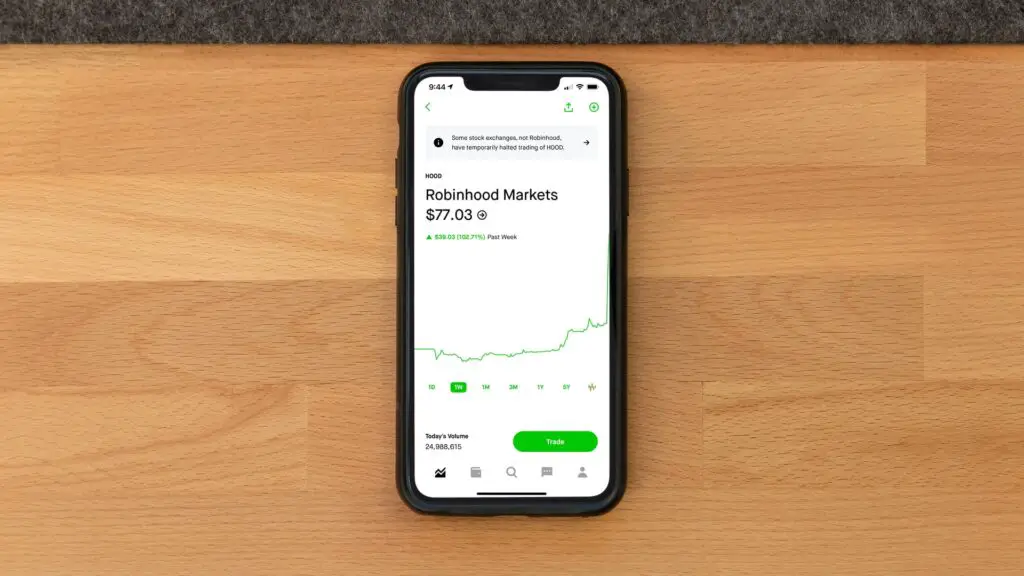

Robinhood has continued its operations from its inception. The company has been able to attract millions of users through its low prices and mobile access. Despite the pandemic, the company flourished in its business. Although previously a private company, Robinhood went public recently. The company is listed on Nasdaq as of July 29, 2021. The company expects to raise north of $2 billion from its IPO.

Formerly, Robinhood allowed its users to trade in stocks and exchange-traded funds. However, the company has expanded its product line. Another popular product that the company provides is access to Cryptocurrency trading. Although this access only included Bitcoin and Ethereum, Robinhood added more currencies to it.

Similarly, Robinhood allows its users to open checking ad saving accounts. It is one of the other services that the company provides. It also comes with a cash management feature. These products have allowed the company to increase its market share significantly. It has also helped the company revolutionize the world of online trading.

How Does Robinhood Work?

Robinhood is an online platform that allows investors to trade online without the need to pay fees. It offers users the ability to buy and sell stocks based on their investment strategy. All users need to do to use the platform is sign up for it. Usually, this process takes a few minutes and requires users to provide basic info. When signing up, the app does not require users to make any payments or deposits. Therefore, opening an account does not cost anything on the platform.

Before providing users access to features, Robinhood will have a review process. This process occurs once users sign up for the platform. When users provide their basic info, their application gets submitted for review. Usually, this review doesn’t take long. However, the platform may reject users that they don’t deem are fit for it.

Once users create an account, they can get access to Robinhood’s services. Usually, users prefer to use the mobile app for the platform. However, it also provides the option to make transactions through the web. Both of these options allow users to use the same products and services. They also have similar features. According to Robinhood, however, most of its users prefer the mobile app.

Before using these features, however, users need to provide the platform with their money. Robinhood is an online financial services platform. Therefore, users need to use their money to make transactions. Deposits are instant, which should be convenient for users. Once they transfer their money, they can use all the features that the app provides.

What is the Robinhood Business Model?

Robinhood business model is similar to other apps that provide the same services. The company offers online brokerage and financial services. However, these features are free. Robinhood allows users to buy and sell stocks online without any commission. It uses its web and mobile apps to offer users its products and services.

While Robinhood introduced a new business model, it has generated competition from various other platforms. Due to the company’s wide range of products and services, it competes with several factors. Therefore, the company attracts competition from brokerages, banks, cryptocurrency exchanges, asset management firms, etc.

Over the years, Robinhood has also adjusted its business model and offered more options to users. The company has introduced various products and services that enhance users’ experiences. Despite these, however, Robinhood has suffered from losses throughout the years. The company has been in a net loss position for a long time. Some experts believe the company’s no-commission policy contributes to its losses.

The no-commission policy also contributes to a lot of confusion for users. Many users are left wondering how Robinhood makes money. The company states that there are several sources of income that it utilizes. These include rebates from market makers and trading venues, Robinhood Gold, stock loan, income generated from cash, and its cash management service, according to Robinhood.com.

How Does Robinhood Make Money?

Before Robinhood, most similar platforms earned money through commissions. Some also had other sources, but these commissions were a majority of their revenue. However, Robinhood changes that by offering users a unique service. It provided users with the ability to make transactions without any commission. Despite that, it does not imply that Robinhood does not make money.

Robinhood does not provide a great deal of information about its income. However, that has to do with the company being private for a long time and recently going public. However, the company did report its operations recently through an S1 form. The company divided its revenues into three categories. These include transaction-based revenues, net interest revenues, and other revenues. By studying these, it is possible to understand how Robinhood makes money.

Transaction-based revenues

Robinhood earns a majority of its revenue from transaction-based revenues. However, these do not include the conventional commissions charged by other platforms. Instead, the company makes money by routing its users’ orders to market makers. These orders consist of all the services it provides, including options, stocks, and cryptocurrency and this process is basically called payment for order flow.

By directing its users to those market makers, Robinhood receives a small compensation as payment. However, these payments are not significant per transaction. For Robinhood, the vast number of transactions allows the company to make these payments worthwhile.

According to Robinhood, these revenues generated $420.4 million in 2021 for the first quarter. This revenue was an increase of 339.6% over the previous period. The company reported that transaction-based revenues made 80% of the company’s overall revenue.

Net interest revenues

Robinhood also makes money through net interest revenue. The company offers users the ability to lend securities. It is similar to margin accounts provided to users. On these transactions, the company charges interest, which constitutes interest income for the company. However, the company also bears interest expense on its credit facilities.

The net interest revenues net off any interest expenses from the interest income generated. The company reported that it made $62.5 million from this segment, which increased by 160.2% over the last period. These revenues constituted 12% of the company’s overall revenues for the first quarter of 2021.

Other revenues

Robinhood also generates revenues from other sources. These include membership fees for the premium Robinhood Gold service. It is a paid subscription service for users that want to use premium features provided by the company. Other revenues constitute the remaining money the company generates.

Robinhood reported that it generated $39.2 billion from this segment in the first quarter of 2021. This revenue was an increase of 396.5% from the previous period. Overall, this segment accounts for 8% of the company’s total profits.

Conclusion

Robinhood is an online financial services company. The company allows users to invest in equities and exchange-traded funds without any commissions. Robinhood’s business model was revolutionary and changed the business. The company makes money from various sources. It divides those sources into three segments, as mentioned above.