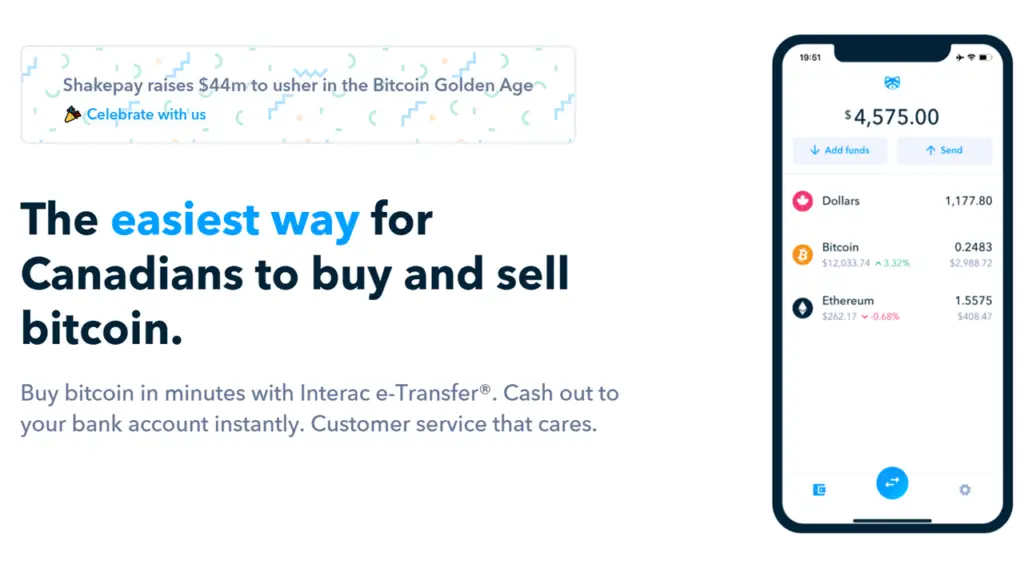

Shakepay is a ‘neobank’ that offers users the ability to purchase and sell cryptocurrencies. Essentially, it operates under the fintech business model that most similar companies follow. Shakepay has been one of the rising platforms on the internet for trading cryptos such as Bitcoin and Ethereum. On top of that, it also offers other services that support those activities.

What is Shakepay?

Shakepay is a fintech company that supports cryptocurrency trading. It operates from Montreal, Canada and focuses on the Canadian market only. Initially, it started its operations in 2015 under Jean Amiouny and Roy Breidi. The founders met when they were studying at McGill University. They both graduated in the same year, 2013. However, Jean was a Civil Engineering major while Roy studied Computer Engineering.

During that time, Jean started taking interest in Bitcoins. However, he did not focus on it initially. At that time, Roy started working at Morgan Stanley. Jean, on the other hand, started working in the consultancy sector. Later, he founded his first company in 2014. It was a Dubai-based company known as White Payments. At the time, it focused on accepting online payments from anyone.

Within a year, Jean sold his company to Payfort. He moved back to Montreal and contacted Roy, who was still working at Morgan Stanley. Subsequently, they met up and started discussing Bitcoins. They kept meeting regularly and came up with an idea for a company. They decided to create a platform to allow anyone to use Bitcoins as a payment method. Consequently, they launched Shakepay.

The founders took their idea to startup accelerator NEXT Canada in 2016. They also began working more on the idea and improving it to meet expectations. In March 2016, they came up with a beta version of the platform. They called it Shake at that time. At the time, Shake focused on being a payment app. It utilized NFC technology to facilitate payments through Bitcoin technology.

However, Shake was only available to a select number of users. After a few months of closed testing, the app released its open beta. Consequently, anyone could join the platform. Two months later, the founders released a Chrome extension for browser-based payments. However, that did not mean success for the company. The company faced an issue with VISA, which stopped its services.

Nonetheless, the founders did not give up. Instead, they ventured into another business. They also raised finance to support their shift in strategy. In 2018, they launched their new product. It wasn’t a payment platform, though. Instead, it focused on P2P, multi-currency mobile wallets. It allowed users to buy and sell Bitcoin from their mobiles with a few clicks. Within a year, the company had over 40,000 customers under Shakepay.

How does Shakepay work?

Shakepay works similar to other mobile wallet apps. Users must download their version of the app from their relevant app store. Once they do so, they must set up an account on the platform. This process is straightforward and does not require much expertise. Primarily, the app requests basic information. For example, it includes the user’s name, address, date of birth, and phone number.

The registration may also cross-check some of this data with the credit bureau databases. Therefore, users must provide correct information to sign up on the platform. On top of that, Shakepay may request users to provide more information if necessary. It may include a selfie video or an image of photo ID documents. Shakepay uses an encrypted process for this data that meets Canada’s Personal Information Protection and Electronic Documents Act.

Once users sign up on the platform, they must deposit funds to start trading. Shakepay doesn’t charge users to deposit funds into the platform. Users can transfer funds into their Shakepay account in several ways. Based on that method, they can deposit funds. This process is straightforward and requires users to provide some information.

Once users have funds in their Shakepay account, they can use the platform to buy cryptocurrencies. These cryptocurrencies can also fund the purchase of other cryptos. Essentially, users can either use their Canadian dollars or existing crypto balance to purchase cryptocurrencies. Depending on the type of transfer, the users may have to wait some time to start buying currencies.

Buying crypto on Shakepay is straightforward. Users can click the “Buy & Sell” button on their dashboard. From there, they can select the currency they want to buy and the one they use as funds. Shakepay will quote them a price for the transaction. Once users confirm the details, they can use the platform to buy crypto. The same step applies to the selling currencies on Shakepay, but in reverse.

What is the Shakepay business model?

Shakepay uses an e-commerce business model. Essentially, it uses the internet to provide services to users. Although the company focuses on users in Canada only, this business model allows expansion. On top of that, the e-commerce business model enables Shakepay to offer its services through mobile apps. Since most similar companies use this approach, it also works for Shakepay.

Shakepay’s business model provides customers with a simple and effective trading method. In this case, this trading activity occurs through cryptocurrencies. However, it does not ignore security and user safety. Being an e-commerce company, such threats always loom for users. For mobile wallets, these threats are more prominent and prevalent. Shakepay, however, provides a safe platform for online trading.

Shakepay’s business model also differs from other competitors and alternatives. The company does not focus on expanding its range of products. Instead, it aims to provide simplicity in its selection. Although it may reduce the number of customers the platform serves, it also brings other users. These customers are the essence of the Shakepay business model.

Similarly, Shakepay uses a fintech business model. The company offers similar services to users as other companies in the industry. Within this model, Shakepay primarily gets commission-based revenues. The commission applies to every transaction process through the Shakepay platform. It is a common source of income for companies using the fintech business model.

How does Shakepay make money?

Shakepay makes money on every transaction process through its platform. For each trade on Shakepay, the company charges a spread. On top of that, Shakepay also makes money from interchange fees on its debit card. This debit card is one of the tools offered under the fintech business model. Nonetheless, the spread on transactions makes up the higher portion of Shakepay’s revenues.

An explanation of the two sources of money for Shakepay is as follows.

Spread

Spread on cryptocurrency trades is the primary income source for Shakepay. The company applies this spread to every transaction involving a sale or purchase. Usually, the amount varies for every transaction. It represents the difference between the purchase and sale price for every cryptocurrency. This difference constitutes the money that Shakepay makes from its platform.

For example, Shakepay may purchase a cryptocurrency for $1,000. However, it may charge the user $1,020 for that crypto. The $20 difference in the transaction constitutes the spread for Shakepay. This process differs from other traditional exchanges. Essentially, those exchanges facilitate trades between users. Shakepay buys and sells cryptocurrencies itself.

Interchange fees

As mentioned above, Shakepay also offers a debit card that users can use for various transactions. These cards came in December 2021 as a product from the platform. Essentially, it has the same features as other debit cards. Unlike other exchanges, Shakepay relies on VISA to power its debit card. When a user uses this card, Shakepay charges an interchange fee.

The interchange fee on the transaction gets paid by the merchant. Shakepay then offers 1% of that amount as cashback to the user, paid in Bitcoin. Consequently, Shakepay makes money while offering users an incentive to use its card. However, interchange fees do not make up a significant portion of the revenues earned by Shakepay.

Conclusion

Shakepay is a fintech company that provides a cryptocurrency trading platform. It also acts as a digital mobile wallet to store those currencies. Essentially, Shakepay offers two types of cryptocurrencies, Bitcoin and Ethereum. The company uses a fintech business model to make money. Its revenue streams include spreads on trades and interchange fees on debit cards.