What is TransferWise?

TransferWise, now known as Wise, is a UK-based financial technology company. The company started its operations in 2011 under Kristo Käärmann and Taavet Hinrikus. Currently, it ranks among one of the top fintech companies in the market. The company operates in the financial services and remittance industry and is publicly listed. In 2020, Wise reported revenues of £302.6 million and a profit of £21.3 million.

The idea behind Wise comes from its founders mentioned above. Kristo and Taavet worked in the UK as Estonian ex-pats. Of them, the former worked as a management consultant at Deloitte. He owned a house in Estonia and wanted to send money to his Estonian bank account. However, the bank charged up to 5% for each transfer. Since his mortgage payments were significant, it resulted in thousands of dollars in bank fees.

Taavet also faced the same issue. At the time, he lived in London and worked at Skype. However, he wanted to send money from his Estonian bank account to the one he had in the UK. Taavet also faced high charges from his account, which he considered high. Due to these issues, they came up with the idea to pay for each other’s expenses. This idea formed the base for TransferWise.

At the time, Kristo agreed to pay Taavet money in the UK for a payment in Estonia. This way, they saved thousands in transfer charges. They also spent their money to develop the idea and came up with the first version of their concept. It led to TransferWise getting launched in 2011. At the time, TransferWise became an instant success. In its first year’s operation, the company moved $13 million in transactions.

In 2012, the company ranked as one of East London’s 20 hottest tech startups by The Guardian. Initially, TransferWise only allowed payments between Euros and Pounds. However, it expanded its operations into other currencies as well. The company also adopted Bitcoin but discontinued it in 2103 due to pressure from banking providers. At the time, TransferWise’s unique system provided significantly lower transfers.

In May 2017, TransferWise announced it processed over £1 billion in transactions each month. It also declared it had turned profitable six years after its incorporation. In 2021, TransferWise also planned on going public. During the same year, it rebranded its product from TransferWise to Wise. This process allowed the company to go beyond its transfer products. In July 2021, the company went public with an $11 billion valuation.

How does TransferWise work?

TransferWise works in a similar way described above. It allows two participants in two countries to make payments for each other. In practice, however, it works differently due to some limitations. Essentially, Wise helps users move money from one country to another. It may also skip the transaction or exchange fee that comes with those transactions. Nonetheless, the company offers its website for users to make transfers.

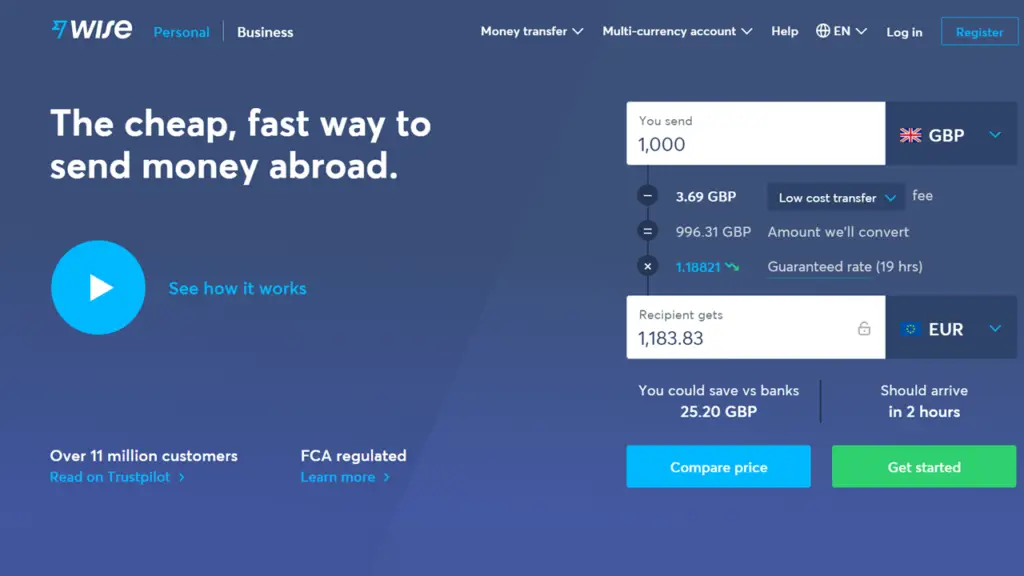

Users seeking to transfer money internationally must go to the Wise website. From there, they can check their fees and exchange rates. The website provides a tool that users can use to determine how much they must pay on a transfer. This tool requires them to put their desired amount and the currency they want to send it to. Once they provide that information, they will get an estimated transfer amount.

Once users calculate their fees, they can start sending money. However, Wise requires them to register first. The registration process is free and straightforward. On top of that, only the user sending the money must create an account on the platform. The recipient doesn’t need to be a user on Wise to receive their amount. Users can choose between an individual or business account. Each of these come with their benefits.

Users can also register and use the process through Wise’s mobile apps. These are available on Android and iOS. Once users register, they must wait to get verified. Usually, this process takes 1-3 business days. The platform also provides tips and tools for users to get verified earlier. Once users get verified, they can start using their Wise account. However, they must provide the transfer details first.

Subsequently, users must specify the location to send their desired amount. Usually, it involves providing information about the recipient, for example, bank details, name, etc. Users can send money to themselves, businesses or others. Once they provide these details, users must pay for the transfer. This amount will include the transfer amount and the charges from the platform.

Once users provide the required information, they can complete the transfer. From there, Wise takes over the process and sends the money. The platform finds another user that wants to transfer money in the opposite direction. It matches both transfers and exchanges money from one user to the other. This process may take a few hours or several days.

What is TransferWise’s business model?

TransferWise’s business model outlines how the company makes money. Primarily, Wise operates in a digital market where it allows money transfers. Therefore, it falls under an e-commerce business model. More specifically, Wise provides financial services through the use of technology. These services fall under the term fintech market or industry.

TransferWise primarily uses a transaction-based business model. Under this model, the company charges its users a fee for each transaction they make. By doing so, the company earns a percentage of each transfer made through its platform. These charges may differ based on the transaction details. It is the primary income source for the company.

On top of that, the company also provides other features and services. These features fall under the financial services model. TransferWise uses its platform to provide services, such as bank accounts, debit cards, etc. With this model, the company offers users similar facilities as other fintech companies. From those services, TransferWise makes money.

Apart from that, TransferWise also provides other services. These services may not produce substantial income. However, they still contribute to the revenues generated through the platform. For example, they include API integrations, business accounts, etc. All of these contribute to the money that TransferWise makes. The company monetizes each of these through different revenue streams.

How does TransferWise make money?

TransferWise makes money in different ways. As mentioned, its primary income source includes the fee-based income from customers. On top of that, the company also makes money from the accounts provided to its users. These accounts are available to business owners and banks. The ways used by TransferWise to make money are the following.

Transaction fees

TransferWise charges its users for each transaction they make. As mentioned above, it involves the transfer of funds from one area to another. For each transfer, the company makes money which becomes its commissions. The commission rates are not specific and may differ based on the transaction details. Nonetheless, the company generates revenues from over 50 currencies.

Borderless account

TransferWise also provides its users with a bank account, known as Borderless. Similarly, users can receive a free debit card powered by MasterCard. The company offers this account and the card for free. However, it makes money when customer exchanges their currencies. Therefore, conversion costs from the Borderless account constitute a part of the money made by TransferWise.

Business account

TransferWise also has a business account for merchants and business owners. With this account, users can create a bank account with Wise. Similarly, they can receive a debit card powered by MasterCard. On top of these features, the account also includes balance and invoice management services. Business owners can automate their payments with these features. While the business account is free, TransferWise makes money for every transaction.

TransferWise for banks

TransferWise doesn’t serve individuals and businesses only. Its customers also include financial institutions, including banks. With TransferWise for banks, these institutions can use the platform to offer low-cost exchange rates and money transfers. The income from this source is similar to the ones above. While the feature is free, TransferWise makes money when a transfer occurs in the account.

Conclusion

TransferWise is a fintech company that provides financial services only. Primarily, it allows for exchange to occur between different countries. TransferWise’s business model is similar to other companies in the same industry. The company also includes several revenues streams within its model. Primarily, TransferWise makes money from transaction-based fees on various facilities.