Ripple is a technology company based in America. The company is well-known for developing and creating the Ripple payment protocol and exchange network. Similarly, the company operates in the fintech company and is among one of the cryptocurrency providers. Another well-known product that comes from the company is the XRP, also known as the Ripple.

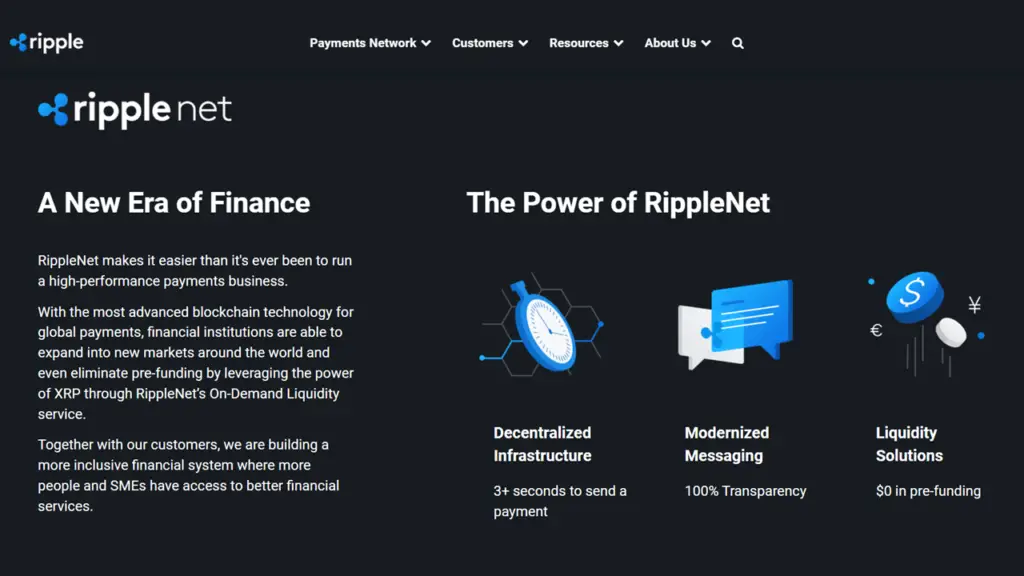

Ripple operates a currency exchange, which comes under its Ripple exchange system. Through this system, the company allows settling payments that can facilitate financial transactions worldwide. On top of that, it also develops and maintains the RippleNet, which is a network for institutions to run their own nodes. Through this system, the company coordinates with financial institutions to operate those nodes.

While some of its products cater to the needs of institutional users, most individuals know Ripple for its XRP. XRP is a cryptocurrency that works through Ripple’s payment network and is available for payments within that network. However, it does not follow a similar method for this cryptocurrency. Therefore, it does not rely on blockchain technology when some cryptocurrencies do.

Due to its distinct system for cryptocurrency, Ripple does not allow the mining of XRP tokens. For other cryptocurrencies, the mining process is highly critical. However, Ripple avoids that through its own patented technology, known as the Ripple Protocol Consensus Algorithm (RPCA). Through this system, the verification of transactions occurs differently.

With the RPCA, all notes within the network must agree to the validity of a transaction unanimously. This feature sets Ripple apart from its other cryptocurrency counterparts. Instead of allowing the mining of XRP, all these cryptos have been pre-mined. While this may seem something adverse, it allows for significantly faster transactions compared to other cryptocurrencies.

Ripple has pre-mined a total of 100 billion XRP coins. Some of these coins are in circulation while the company still holds the others. However, this step had garnered some adverse attention, with experts claiming it hurt the currency. Therefore, Ripple placed 55 billion XRPs in escrow. Of these, the company distributed 1 billion coins to the market every month.

The current market price of the XRP token is about $1. Therefore, every time the company releases coins into the market, it makes about $1 billion. On top of that, it also releases a quarterly report detailing the number of XRPs sold and their value. Most investors may wonder whether Ripple is profitable and about the advantages and disadvantages of investing in it.

Is Ripple Profitable?

Ripple can be profitable from its operations. The company generates revenues from several sources, which don’t relate to or depend on each other. Therefore, if one source is unavailable, the company can rely on other streams to make money. This independence allows the company to make money and be profitable overall. However, it is crucial to understand how these sources help the company generate earnings.

The most vital income source for Ripple is the XRP sales. The company holds a significant number of the total pre-mined XRP tokens. Of these, some are in an escrow, which the company releases into the market each month. Every time it occurs, the process makes almost $1 billion in money. Overall, there were 100 billion coins that the company used as its supply. Of these, the company still holds a significant portion.

Due to the significant number of XRPs that the company owns, it can make substantial profits. However, the company releases these in the market through a strategy not to dilute the market. By doing so, it does not flood the market with XRPs to avoid devaluing the currency. With this strategy, Ripple makes significant profits every time it releases new tokens into the market.

Apart from the XRP, Ripple also generates revenues from any transactions that users perform. Every time a user transfers money through RippleNet, they pay a transaction fee. Although these fees are low, the company depends on the volume of transactions to make significant profits. This process allows the company to generate profits and makes Ripple profitable.

Apart from these two sources, Ripple also generates profits from loans. The company holds significant finance from its users. It uses this finance to provide loans to financial institutions, in exchange for which it earns money. Usually, the risks associated with these loans is substantially lower compared to those made to individuals or other parties. However, it still forms profits for the company in exchange for low costs.

Another source of profits for Ripple is the investments the company has made over its lifetime. The company has been active in the market and used its resources to invest in several companies. In most cases, these investments do not generate regular income. However, these can be a substantial income stream when the other income sources fail.

What are the advantages of investing in Ripple?

Although not a prominent name in the crypto market, Ripple can be a valuable investment. Most investors want to understand the advantages of investing in Ripple. In actuality, there are several benefits of doing so. Some of the primary advantages of investing in Ripple are as below.

High ranking

Although not as popular as some other cryptocurrencies, Ripple still holds a decent market. In many markets, the company is growing in popularity, evident in the total number of its investors. Similarly, the demand for its primary product, the XRP, is rising worldwide. Although Ripple is not the primary choice for cryptocurrencies, it ranks highly among institutional users.

Customer base

For any company, the customer base provides a base for it to continue its operations. As mentioned, Ripple’s customers include both individuals and financial institutions. These customers provide high stability to the company, which is unlikely to wane anytime soon. Due to this stability, investors can achieve a significant advantage from investing in Ripple.

Unique product

In essence, Ripple provides a cryptocurrency, which is similar to some other options. However, the system it uses behind that cryptocurrency makes it more unique. As mentioned, Ripple’s XRP is significantly faster in processing transactions while also including lower fees. Similarly, it has an exchange network, which provides a base for many financial institutions to conduct operations.

Competitive advantage

Ripple is significantly different compared to its rivals and competitors. The company doesn’t allow users to mine cryptocurrencies. Instead, it limits its XRP coins to 100 billion, which makes it more controllable. Similarly, XRP transactions get executed and recorded on the XRP ledger. This feature is similar to other cryptocurrencies, making it easy to understand for users.

Several income streams

Most companies rely on a single income stream to make money. However, Ripple earns from multiple sources, which makes its profits more stable. For investors, it means the company will continue generating revenues even when one product fails. Therefore, investors get assurance about the investments they make.

What are the disadvantages of investing in Ripple?

While investing in Ripple can be advantageous, it also comes with some disadvantages. Some of these disadvantages relate to the distinct products and services that it offers. However, others may also come from its activities and the way it operates. Overall, some of the disadvantages of investing in Ripple include the following.

Anonymity

Most cryptocurrencies focus on providing anonymous payments and services to users. It is one of the primary reasons why these currencies have become prevalent worldwide. However, Ripple does not provide the same anonymity. While the company is trying its best to achieve it, it still has some obstacles in the way. Due to this, the company can face significant backlash, making it a risky investment.

XRP distribution

XRP coins are pre-mined most of which the company still owns. Therefore, the company has significant control over the price movement associated with these coins. In the past, Ripple received criticisms for this control. Although the company has taken steps to answer those criticisms, it has not tackled them completely. Due to this issue, most experts warn against investing in Ripple.

Competitors

While investing in Ripple has its advantages, its competitors provide a standard product, which can be problematic. Furthermore, the company operates in several markets, most of which has established names. These competitors can significantly hinder the company’s efforts to increase its profits. Therefore, it may put investors at a disadvantage for investing in Ripple.

Conclusion

Ripple is a US-based company that is well-known for its Ripple payment protocol and exchange network. The company has customers from various sectors and serves some large financial institutions. Furthermore, it generates income from several sources, which makes Ripple profitable. However, there are many advantages and disadvantages of investing in Ripple, as stated above.