Tesla is an American Company that was founded by Elon Musk in 2003 but named after Nikola Tesla, a renowned inventor and scientist. At the heart of the company is the design and manufacture of high-performance vehicles that are fully electric. Other services that define the company include retail merchandise, lifestyle products, solar panels, energy storage products, financial services, and auto services.

The Company is guided by the mission: “To accelerate the world’s transition to sustainable energy”, while the vision is “To create the most compelling car company by driving the world’s transition to electric vehicles.”

In this article, we cover Tesla Inc.’s SWOT analysis which includes both internal and external strategic factors. Keep reading to get to understand more about the SWOT analysis of the company.

Tesla Inc. – At a Glance

| Name | TESLA, Inc |

| Website | https://www.tesla.com/ |

| Founders | Elon Musk, Martin Eberhard, Ian Wright, JB Straubel, Marc Tarpennin, |

| Chief Executive Officer (C.E.O.) | Elon Reeve Musk (from October 2008) |

| Chairman | Robyn Denholm |

| Headquarters | Palo Alto, California |

| Type of Corporation | Public |

| Year Founded | 2003 |

| Revenues (2019) | $24.5 Billion |

| Company Valuation (approximate) | $208 Billion |

| Key Products/Services | Tesla motor vehicles, Auto service, Financial services, Energy Storage, Solar panels, Retail Merchandise, Lifestyle Products |

| Key Competitors | 2018 Kia Soul EV, 2018 BMW i3, 2018 Nissan Leaf, 2018 Volkswagen e-Golf, 2018 Hyunda loniq EV, 2018 Chevrolet Volt EV. |

| Subsidiaries | SolarCity, Maxwell Technologies, Teslsa Grohmann Automation |

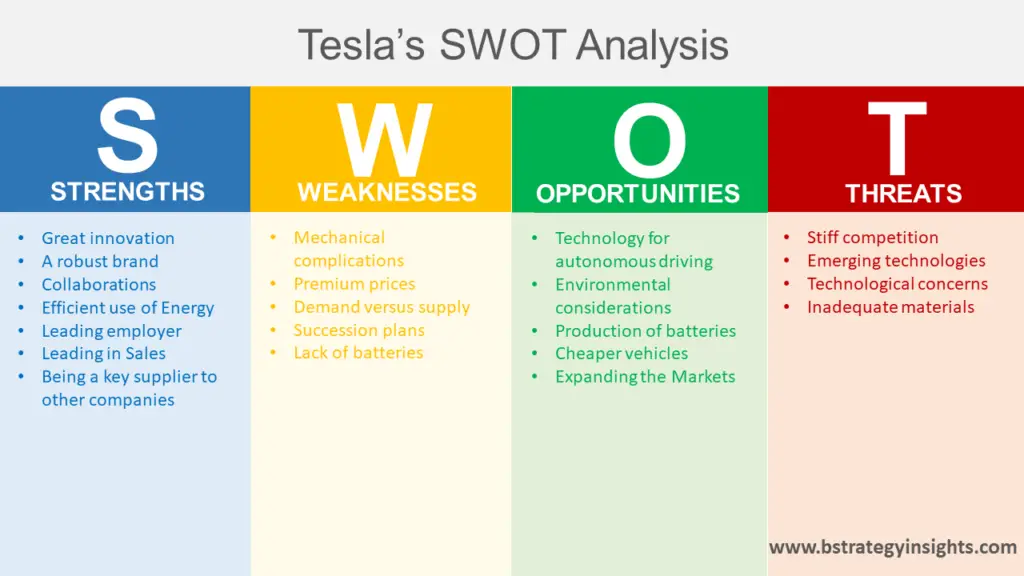

SWOT Analysis of Tesla

In the SWOT analysis of Tesla, we will look at the internal factors, which include the Strengths and Weaknesses, as well as external factors, Opportunities, and Threats. Let’s go through it together below.

Tesla’s Strengths

Great innovation

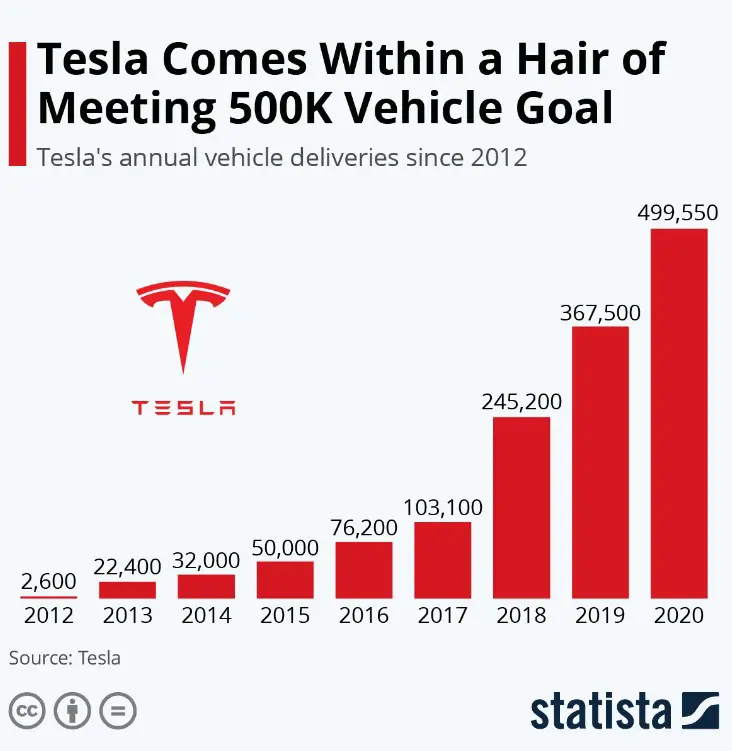

The designs from Tesla have been topnotch, bearing overwhelming evidence of careful thought given to the engineering process of designing electric vehicles, offering extra comfort to their clients. As of 2019, the company continued to register increased sales, actually delivering close to half a million vehicles.

Image Source: Statista

A robust brand

Their customers have total trust in the company’s ability to develop products that use clean energy, making it famous for its profitability.

Collaborations

The company has partnered with great companies like Southeast APDA, which have propelled Tesla into the global market.

Efficient use of Energy

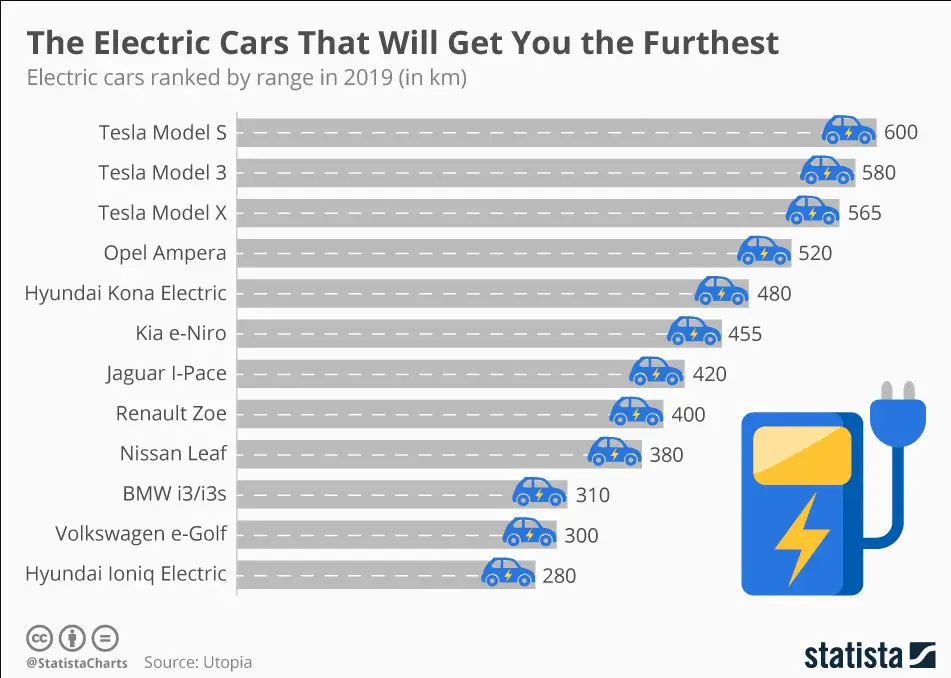

The company has leveraged sources of renewable energy like solar power to run its products, especially in the case of electric vehicles. A 2019 report by Statista indicated that Tesla’s electric cars were considered the best when it came to covering the longest or furthest distance. As a matter of fact, the first three positions were taken by Tesla, with the three models covering between 565 and 600 kilometers.

Image source: Statista

Leading employer

The company prides itself in diversity and inclusivity in its innovative culture; no wonder it has been lauded by Wall Street Journal reports. Tesla has also been applauded for employing young jobseekers who are full of energy and fresh talents! In 2019, the company was featured in Forbes under Best Employers in the United States.

Leading in Sales

By May 2019, the Tesla Model 3 had dominated electric vehicle sales in the US, totaling up to 187,971 vehicles. Tesla Model S followed closely in position three, selling 149,367 vehicles.

Being a key supplier to other companies

Toyota company receives a lot of spare parts from Tesla, especially for Toyota’s second-generation cars like RAV4 EV.

Tesla’s Weaknesses

Tesla’s weaknesses are as follows:

Mechanical complications

More often than not, the risks that come with increased standards of innovation are equally high. Such a situation may result in technical delays in launching automobiles and other products.

Premium prices

Because of its prominent position in the manufacture of clean energy brands, many admirers of the company cannot afford its products.

Demand versus supply

There was a sharp drop of more than 30% between the vehicles delivered in the last quarter of 2018 and those delivered in the first quarter of 2019, which stood at 63,000 cars. Complicated procedures and a lot of experiments may result in a technical deficit of cars. The inability of Tesla to increase the volume of production to meth the market needs may not be in good taste for their customers.

Succession plans

With Elon Musk dominating the face of the company and with a full plate on his desk, the question of what is next after his exit may adversely affect the company.

Lack of batteries

Although Tesla has been in the lead in manufacturing energy-saving cars, its efforts have been hampered by a chronic shortage of batteries, a situation that has resulted in reduced sales.

Tesla’s Opportunities

Tesla’s opportunities are as follows:

Technology for autonomous driving

The company’s autopilot has been applauded not just for its convenience but also for safety considerations. The company may leverage customers’ trust and increase its market shares.

Environmental considerations

The demand for fuel-driven vehicles has been going down, even as consumers become more conscious of the environment, a perspective that will push the demand for electric vehicles even higher.

Production of batteries

With the company planning to manufacture its own batteries, the production cost of the company will definitely go down while at the same time creating a lot of job opportunities that culminate in economic growth and prosperity.

Cheaper vehicles

One of the reasons for the high prices of Tesla models is the company’s massive investment in innovation. The company needs to look into the question of affordability, even as it seeks to expand its market.

Expanding the Markets

The company may need to look into the Asian market, where many opportunities abound for renewable energy and automotive markets. By expanding its market base, the company would be in a position to stabilize financially.

Tesla’s Threats

Tesla’s threats are as follows:

Stiff competition

There are other major companies that have doubled efforts in research on the use of renewable energy in powering automobiles. Such companies include Volkswagen and BMW. Notably, the competitors are not only launching environment-friendly vehicles but also offering them at reduced prices, making them more affordable to most people.

Emerging technologies

Increased competition in more innovative means of using energy in vehicles may translate to increased costs of operation. This may directly result in dwindled company profits in the long run.

Technological concerns

There are many customers who do not feel very safe riding in self-driving cars. This trend appears to be on the rise with older people, especially those aged 55 and above. That notwithstanding, it would be worth noting that most countries in the world do not have proper regulations on self-driving cars, including the United States of America. The subsequent repercussions here would general lack of many consumers willing to risk buying a Tesla.

Inadequate materials

Volatility in the prices of materials may have both short-term and long-term impacts on the speed and quality of production in the company. Such materials include lithium-ion cells, cobalt, copper, nickel, lithium, steel, and aluminium.

Conclusion

In this analysis, Tesla features as a very strong company, and in spite of some weaknesses, it still has a lot of opportunities to tap from in a bid to work on immediate and long-term threats.